Lea County New Mexico Gross Receipts Tax Rate . From the department’s map portal. Identify the appropriate grt location code and tax rate by clicking on the map at the location of interest. Sales tax rates in lea. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. Zoom to + zoom in zoom in It varies because the total rate combines rates imposed by the. Tax rates provided by avalara are updated regularly. Lea county collects a 0.375% local sales tax, the. Look up 2024 sales tax rates for lea county, new mexico. Trd gis data disclaimer applies:. To reach the taxation and revenue. Groceries are exempt from the lea county and new mexico state sales taxes. The gross receipts tax rate varies throughout the state from 4.875% to 8.9375%. Lea county, new mexico has a maximum sales tax rate of 7.1875% and an approximate population of 48,175. Esri, here, garmin, fao, noaa, usgs, epa, nps |.

from www.land.com

Trd gis data disclaimer applies:. To reach the taxation and revenue. From the department’s map portal. The gross receipts tax rate varies throughout the state from 4.875% to 8.9375%. Look up 2024 sales tax rates for lea county, new mexico. Groceries are exempt from the lea county and new mexico state sales taxes. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. It varies because the total rate combines rates imposed by the. Lea county collects a 0.375% local sales tax, the. Lea county, new mexico has a maximum sales tax rate of 7.1875% and an approximate population of 48,175.

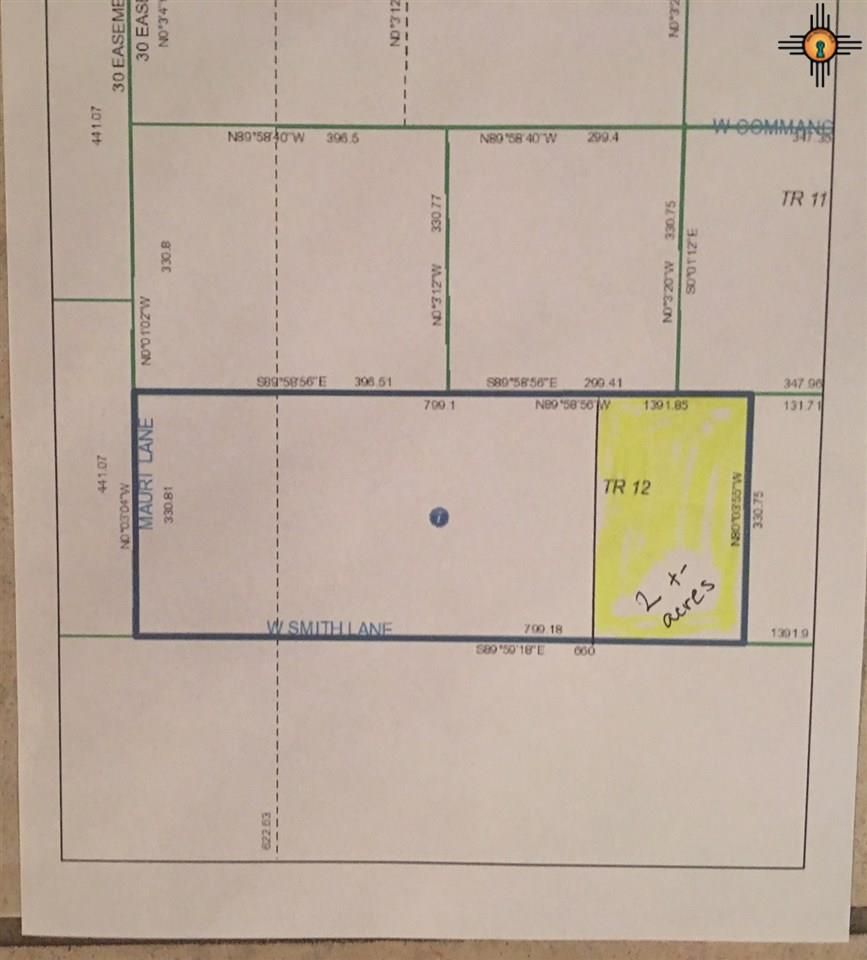

2 acres in Lea County, New Mexico

Lea County New Mexico Gross Receipts Tax Rate New mexico gross receipts quick find is available. Trd gis data disclaimer applies:. Sales tax rates in lea. Identify the appropriate grt location code and tax rate by clicking on the map at the location of interest. The gross receipts tax rate varies throughout the state from 4.875% to 8.9375%. Look up 2024 sales tax rates for lea county, new mexico. New mexico gross receipts quick find is available. It varies because the total rate combines rates imposed by the. Lea county, new mexico has a maximum sales tax rate of 7.1875% and an approximate population of 48,175. To reach the taxation and revenue. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. Esri, here, garmin, fao, noaa, usgs, epa, nps |. Tax rates provided by avalara are updated regularly. Lea county collects a 0.375% local sales tax, the. Zoom to + zoom in zoom in From the department’s map portal.

From libbeywbel.pages.dev

Santa Fe County Gross Receipts Tax Rate 2024 Gustie Felisha Lea County New Mexico Gross Receipts Tax Rate Esri, here, garmin, fao, noaa, usgs, epa, nps |. Look up 2024 sales tax rates for lea county, new mexico. Zoom to + zoom in zoom in Tax rates provided by avalara are updated regularly. Lea county collects a 0.375% local sales tax, the. The gross receipts tax rate varies throughout the state from 4.875% to 8.9375%. Sales tax rates. Lea County New Mexico Gross Receipts Tax Rate.

From www.researchgate.net

New Mexico natural gas and oil basins and uplifts including Eddy, Lea Lea County New Mexico Gross Receipts Tax Rate Tax rates provided by avalara are updated regularly. Identify the appropriate grt location code and tax rate by clicking on the map at the location of interest. Lea county collects a 0.375% local sales tax, the. It varies because the total rate combines rates imposed by the. Trd gis data disclaimer applies:. This map represents boundaries and rates for new. Lea County New Mexico Gross Receipts Tax Rate.

From slideplayer.com

Virginia’s Business Climate Fiscal Analytics. Ltd. August, ppt download Lea County New Mexico Gross Receipts Tax Rate Esri, here, garmin, fao, noaa, usgs, epa, nps |. To reach the taxation and revenue. Tax rates provided by avalara are updated regularly. Groceries are exempt from the lea county and new mexico state sales taxes. Lea county, new mexico has a maximum sales tax rate of 7.1875% and an approximate population of 48,175. It varies because the total rate. Lea County New Mexico Gross Receipts Tax Rate.

From stoicsvisvesvarayar.netlify.app

Lea County New Mexico Map America Map Game Lea County New Mexico Gross Receipts Tax Rate This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. Groceries are exempt from the lea county and new mexico state sales taxes. The gross receipts tax rate varies throughout the state from 4.875% to 8.9375%. Trd gis data disclaimer applies:. It varies because the total rate combines. Lea County New Mexico Gross Receipts Tax Rate.

From sftreasurer.org

Gross Receipts Tax (GR) Treasurer & Tax Collector Lea County New Mexico Gross Receipts Tax Rate Trd gis data disclaimer applies:. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. To reach the taxation and revenue. New mexico gross receipts quick find is available. Groceries are exempt from the lea county and new mexico state sales taxes. From the department’s map portal.. Lea County New Mexico Gross Receipts Tax Rate.

From taxfoundation.org

Does Your State Have a Gross Receipts Tax? State Gross Receipts Taxes Lea County New Mexico Gross Receipts Tax Rate Sales tax rates in lea. To reach the taxation and revenue. It varies because the total rate combines rates imposed by the. Lea county collects a 0.375% local sales tax, the. Esri, here, garmin, fao, noaa, usgs, epa, nps |. From the department’s map portal. New mexico gross receipts quick find is available. Groceries are exempt from the lea. Lea County New Mexico Gross Receipts Tax Rate.

From www.hartenergy.com

Marketed Operated Assets, HBP Leasehold, Lea County, New Mexico Hart Lea County New Mexico Gross Receipts Tax Rate Sales tax rates in lea. Lea county, new mexico has a maximum sales tax rate of 7.1875% and an approximate population of 48,175. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. Look up 2024 sales tax rates for lea county, new mexico. Trd gis data disclaimer. Lea County New Mexico Gross Receipts Tax Rate.

From www.researchgate.net

Relative location of the wells used, spreading over Lea and Eddy Lea County New Mexico Gross Receipts Tax Rate New mexico gross receipts quick find is available. Groceries are exempt from the lea county and new mexico state sales taxes. Trd gis data disclaimer applies:. Lea county, new mexico has a maximum sales tax rate of 7.1875% and an approximate population of 48,175. Identify the appropriate grt location code and tax rate by clicking on the map at the. Lea County New Mexico Gross Receipts Tax Rate.

From www.formsbank.com

Form Crs1Long Form Combined Report System Nm Taxation And Revenue Lea County New Mexico Gross Receipts Tax Rate New mexico gross receipts quick find is available. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. Esri, here, garmin, fao, noaa, usgs, epa, nps |. The gross receipts tax rate varies throughout the state from 4.875% to 8.9375%. Trd gis data disclaimer applies:. Lea county, new. Lea County New Mexico Gross Receipts Tax Rate.

From www.niche.com

2021 Best Places to Live in Lea County, NM Niche Lea County New Mexico Gross Receipts Tax Rate Sales tax rates in lea. Lea county collects a 0.375% local sales tax, the. Groceries are exempt from the lea county and new mexico state sales taxes. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. Identify the appropriate grt location code and tax rate by clicking. Lea County New Mexico Gross Receipts Tax Rate.

From www.land.com

40 acres in Lea County, New Mexico Lea County New Mexico Gross Receipts Tax Rate New mexico gross receipts quick find is available. Sales tax rates in lea. Identify the appropriate grt location code and tax rate by clicking on the map at the location of interest. Lea county, new mexico has a maximum sales tax rate of 7.1875% and an approximate population of 48,175. Zoom to + zoom in zoom in Groceries are exempt. Lea County New Mexico Gross Receipts Tax Rate.

From nysdcablog.blogspot.com

Tax Receipt Template Lea County New Mexico Gross Receipts Tax Rate Tax rates provided by avalara are updated regularly. Zoom to + zoom in zoom in The gross receipts tax rate varies throughout the state from 4.875% to 8.9375%. Lea county collects a 0.375% local sales tax, the. Sales tax rates in lea. To reach the taxation and revenue. It varies because the total rate combines rates imposed by the. Groceries. Lea County New Mexico Gross Receipts Tax Rate.

From sftreasurer.org

Gross Receipts Tax (GR) Treasurer & Tax Collector Lea County New Mexico Gross Receipts Tax Rate Esri, here, garmin, fao, noaa, usgs, epa, nps |. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule. New mexico gross receipts quick find is available. Trd gis data disclaimer applies:. Lea county collects a 0.375% local sales tax, the. Identify the appropriate grt location code and. Lea County New Mexico Gross Receipts Tax Rate.

From www.formsbank.com

Form Crs1 Combined Report System (Long Form) State Of New Mexico Lea County New Mexico Gross Receipts Tax Rate To reach the taxation and revenue. Sales tax rates in lea. Lea county, new mexico has a maximum sales tax rate of 7.1875% and an approximate population of 48,175. Look up 2024 sales tax rates for lea county, new mexico. Lea county collects a 0.375% local sales tax, the. Identify the appropriate grt location code and tax rate by clicking. Lea County New Mexico Gross Receipts Tax Rate.

From www.researchgate.net

Oil and gas production in Eddy and Lea counties, New Mexico. Download Lea County New Mexico Gross Receipts Tax Rate Groceries are exempt from the lea county and new mexico state sales taxes. From the department’s map portal. New mexico gross receipts quick find is available. Trd gis data disclaimer applies:. It varies because the total rate combines rates imposed by the. Identify the appropriate grt location code and tax rate by clicking on the map at the location. Lea County New Mexico Gross Receipts Tax Rate.

From invoicewriter.com

Massive Invoice Archive Lea County New Mexico Gross Receipts Tax Rate Tax rates provided by avalara are updated regularly. From the department’s map portal. New mexico gross receipts quick find is available. Esri, here, garmin, fao, noaa, usgs, epa, nps |. To reach the taxation and revenue. Zoom to + zoom in zoom in Sales tax rates in lea. It varies because the total rate combines rates imposed by the.. Lea County New Mexico Gross Receipts Tax Rate.

From familypedia.fandom.com

Lea County, New Mexico Familypedia Fandom Lea County New Mexico Gross Receipts Tax Rate Identify the appropriate grt location code and tax rate by clicking on the map at the location of interest. Tax rates provided by avalara are updated regularly. Groceries are exempt from the lea county and new mexico state sales taxes. New mexico gross receipts quick find is available. To reach the taxation and revenue. Sales tax rates in lea. From. Lea County New Mexico Gross Receipts Tax Rate.

From www.niche.com

2023 Safe Places to Live in Lea County, NM Niche Lea County New Mexico Gross Receipts Tax Rate Lea county collects a 0.375% local sales tax, the. Groceries are exempt from the lea county and new mexico state sales taxes. It varies because the total rate combines rates imposed by the. Esri, here, garmin, fao, noaa, usgs, epa, nps |. Identify the appropriate grt location code and tax rate by clicking on the map at the location of. Lea County New Mexico Gross Receipts Tax Rate.